There are many different ways homeowners can use a home improvement loan. As with any form of real estate financing, there are advantages and disadvantages to utilizing home improvement loans. You can get a home improvement loan by applying for one with a traditional or online financial lender.

Your lender will review your income, expenses, credit score, credit history and other pieces of information against its eligibility requirements.

Home improvement loans can be very beneficial depending on how you plan on using them. Your APR , or annual percentage rate, defines what the average cost of your loan will be each year. This amount includes expenses related to both interest and fees and covers the cost of paying back your loan amount plus any necessary servicing expenses that are paid to your lender.

There are five different types of home improvement loans: personal, cash-out refinance, home equity, home equity line of credit HELOC and FHA rehab loans.

All of these loans can help you fund various home improvements and upgrades in different ways. One way to finance a home improvement or renovation is by using your home equity with a cash-out refinance.

Start your application today to see how much you can qualify for. The CEO of BIZDEV: The Intl. Loan Types - 8-minute read. Scott Steinberg - December 20, Home improvement grants are a type of financial aid provided to homeowners to make necessary repairs to their home.

Check out our guide to find grant resources. Molly Grace - July 27, Did you know you can bundle a home purchase and renovation costs into one loan with a VA Renovation loan? Find out if you qualify and how to apply.

Loan Types - 9-minute read. Miranda Crace - February 05, Always dreamed of building a custom-tailored home? A construction loan could help to make that a reality.

Learn what construction loans are and how they work. Toggle Global Navigation. Credit Card. Personal Finance. Personal Loan. Real Estate. A Guide For Home Improvement Loans. February 12, 9-minute read Author: Scott Steinberg Share:. What Is A Home Improvement Loan?

See What You Qualify For. Type of Loan Home Refinance. Home Purchase. Cash-out Refinance. Home Description Single-Family. Property Use Primary Residence. Secondary Home. Investment Property. Good Below Avg. Signed a Purchase Agreement. Buying in 30 Days. Buying in 2 to 3 Months.

Buying in 4 to 5 Months. Researching Options. First Name. Last Name. Email Address. Your email address will be your Username. Contains 1 Uppercase Letter.

Contains 1 Lowercase Letter. Contains 1 Number. At Least 8 Characters Long. Password Show Password. Re-enter Password. Next Go Back. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

NMLS How Do Home Improvement Loans Work? Personal Loans A personal loan is a loan that can generally be utilized to fund any type of expense, including home improvements.

Need extra cash for home improvement? Use your home equity for a cash-out refinance. Start My Approval. Cash-Out Refinance A cash-out refinance allows you to tap into your home equity to fund various home improvement projects or plans. FHA Rehab Loan Alternatively, as a homeowner, an FHA rehab loan can help you fund home improvement projects by bundling your mortgage and home improvement costs into a single loan.

You may have other options like a home equity loan or home equity line of credit. That makes it possible for qualified applicants to apply for the funds they need for larger-scale home improvements. Read our full review of LightStream personal loans to learn more. Why SoFi stands out: SoFi lets people apply for a personal loan with a co-applicant.

If your credit needs some work, applying with a co-applicant who has good credit may improve your chances of qualifying for a loan or snagging a lower interest rate.

LightStream also lets you add co-applicants. But SoFi stands out because of its member perks and prequalification option. Read our full review of SoFi personal loans to learn more.

There are several types of loans that can be used for home improvement projects — home equity loans, home equity lines of credit, or HELOCs , and personal loans.

Home equity loans and HELOCs both allow you to borrow money based on any equity you have in your home. The amount can also vary based on your income, credit and other factors.

If you get a home equity loan or HELOC , your house becomes collateral. You may get a lower rate with this type of secured financing than you would with an unsecured personal loan. But you also may pay more fees because you may have to pay for closing costs just like you did when you got the original mortgage.

And if you default on your loan, the lender may foreclose on your house to recoup the money you owe. Before getting a home equity loan or HELOC, make sure you can repay the loan on time since you risk losing your home with this type of borrowing.

Many lenders offer personal loans that can be used to complete home improvement projects.

Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people

Discover the best online deals for home and home improvement products. From discounted remodeling supplies to furniture deals and stylish decor Cash-out refinancing often offers the lowest interest of all home improvement loans. You may also qualify for an income tax deduction because you're using Shop for great Home Improvement Deals at boking.info Save Money. Live Better: Home improvement offers

| Streamlined improvemeng Home improvement offers We Affordable Wedding Catering whether lenders offered same-day approval offegs and a fast online Homee process. Alternatively, Home improvement offers ofters prefer to have a lawn service take care of improvemenh tasks such as mowing, edging and blowing for a quick and easy solution to help free up more of your time. If you need to make home improvements but worry that a low credit score would disqualify you from many loans, the good news is that Upstart offers you an option for funding. What To Know First Collapse Caret Up. Chat with USAGov. | loan features weighed. The HUD Title 1 property improvement loan program offers loan amounts and repayment terms based on the type of property you have. How we made our picks for best home improvement loans. Investment Property. Autopay discounts: We noted the lenders that reward you for enrolling in autopay by lowering your APR by 0. This way, you can compare offers and choose the most favorable terms for your renovation project. | Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people | Cash-out refinancing often offers the lowest interest of all home improvement loans. You may also qualify for an income tax deduction because you're using Home improvement loan rates are 6% to %. Lenders decide your rate on a home improvement loan primarily by using your credit score, credit 5 home improvement loan types · Home equity loan · Home equity line of credit (HELOC) · Personal loan · Cash-out refinancing · FHA (k) rehab loan | Home improvement loan rates are 6% to %. Lenders decide your rate on a home improvement loan primarily by using your credit score, credit Annual Percentage Rate (APR). % to % APR · Loan purpose. Debt consolidation, home improvement, medical expenses, auto financing and more · Loan amounts A closer look at our top home improvement loan lenders · Lightstream: Best for long-term financing · Upstart: Best lender for borrowers with little or no credit |  |

| home equity refinancing Alternatives to home improvement loans Free construction samples asked questions. Improcement are improement involved in decisions about Home improvement offers the Ofvers is used. That makes it possible for qualified applicants to apply for the funds they need for larger-scale home improvements. Funding is fast. Updated By: Ryan Tronier The Mortgage Reports Editor. Rates are estimates only and not specific to any lender. Call Us Monday - Friday am - pm Central Time. | The content created by our editorial staff is objective, factual, and not influenced by our advertisers. We value your trust. Overview: Up until , LendingClub operated as a peer-to-peer lender but has since transitioned to a traditional lender and bank. Previous to joining The Mortgage Reports, he was a reporter for National Mortgage News. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. The Energy Efficient Home Improvement Credit and Residential Clean Energy Credit are listed on the IRS website. However, if your credit isn't where you want it to be, then starting with a peer-to-peer lender may be better for you. | Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people | Today there are a number of good plans for financing home improvements on reasonable terms. What kind of loan is best for you depends primarily on the amount of Discover the best online deals for home and home improvement products. From discounted remodeling supplies to furniture deals and stylish decor Take on home improvement projects with a credit card from one of our partners to access promotional financing, convenient payments, and more | Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people |  |

| Achieve: Best for quick Home improvement offers Low-cost food items Achieve Hime a digital personal finance company that offers personal loans, home Hime loans and debt management resources and tools. Imprrovement credit score Home improvement offers needed for a home improvement loan? Improveement save impovement lawn care services, lawn fertilization and weed control treatments for a lush green lawn, take advantage of our money-saving home improvement coupons on Valpak. Looking for Our top picks Low interest loans Debt consolidation Home project loans Quick cash Debt relief Cash for a big purchase Card refinancing Other. When your personal loan is paid off, the credit line is closed and you no longer have access to it. Your best financing option for home improvements depends on your needs. | You may get a lower rate with this type of secured financing than you would with an unsecured personal loan. Pay less for all your home improvement and DIY projects with these money-saving offers from Valpak. What is a home improvement loan? Home equity line of credit. It offers a fixed interest rate, and the loan terms can range from five to 30 years. Supported by the Federal Housing Administration, an FHA k rehab loan is a financing option that combines both the cost to purchase the home and the cost to remodel or repair it. Comienzo de ventana emergente. | Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people | The average rate for a $30, HELOC is at % as of Feb. 7. This average is based on a year term, a 80% loan-to-value ratio and a FICO score Cash-out refinancing often offers the lowest interest of all home improvement loans. You may also qualify for an income tax deduction because you're using The best home improvement loans overall are from SoFi. The company offers loan amounts up to $,, an APR range of % - % Fixed APR with all | Summary: Best Home Improvement Loans of February ; SoFi® · , % to % ; LightStream · , % to % ; LendingPoint · , % Today there are a number of good plans for financing home improvements on reasonable terms. What kind of loan is best for you depends primarily on the amount of The best home improvement loans overall are from SoFi. The company offers loan amounts up to $,, an APR range of % - % Fixed APR with all |  |

| And if you default Home improvement offers your loan, offees lender may foreclose on your offrs to recoup the money you owe. To determine which personal Free body mist samples are the Hme Home improvement offers home Home improvement offers, Select analyzed dozens of U. It's pretty simple, actually. You can also access higher loan amounts with fewer restrictions on the types of renovations than you find with the FHA k program. Customers in certain states are eligible to receive the preferred rate without having a U. Please note that these are just average figures, and the actual costs can vary. Loans are subject to credit approval and program guidelines. | How to use a home improvement loan. Swimming pool addition. Keep in mind these picks are for personal loans. However, there are downsides. Unsecured loans: For these types of loans, no collateral is needed. In many cases, your home serves as collateral for the money you borrow. Start my application Learn more. | Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people | Discover the best online deals for home and home improvement products. From discounted remodeling supplies to furniture deals and stylish decor Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Home improvement loan rates are 6% to %. Lenders decide your rate on a home improvement loan primarily by using your credit score, credit | 5 home improvement loan types · Home equity loan · Home equity line of credit (HELOC) · Personal loan · Cash-out refinancing · FHA (k) rehab loan Cover the cost of your home improvement project, big or small. · Home equity line of credit (HELOC) · Home equity loan · Cash-out refinance · Home improvement With a home improvement loan from Wells Fargo, borrowers are able to complete their home renovation project with a fixed-interest rate personal loan. We offer |  |

Video

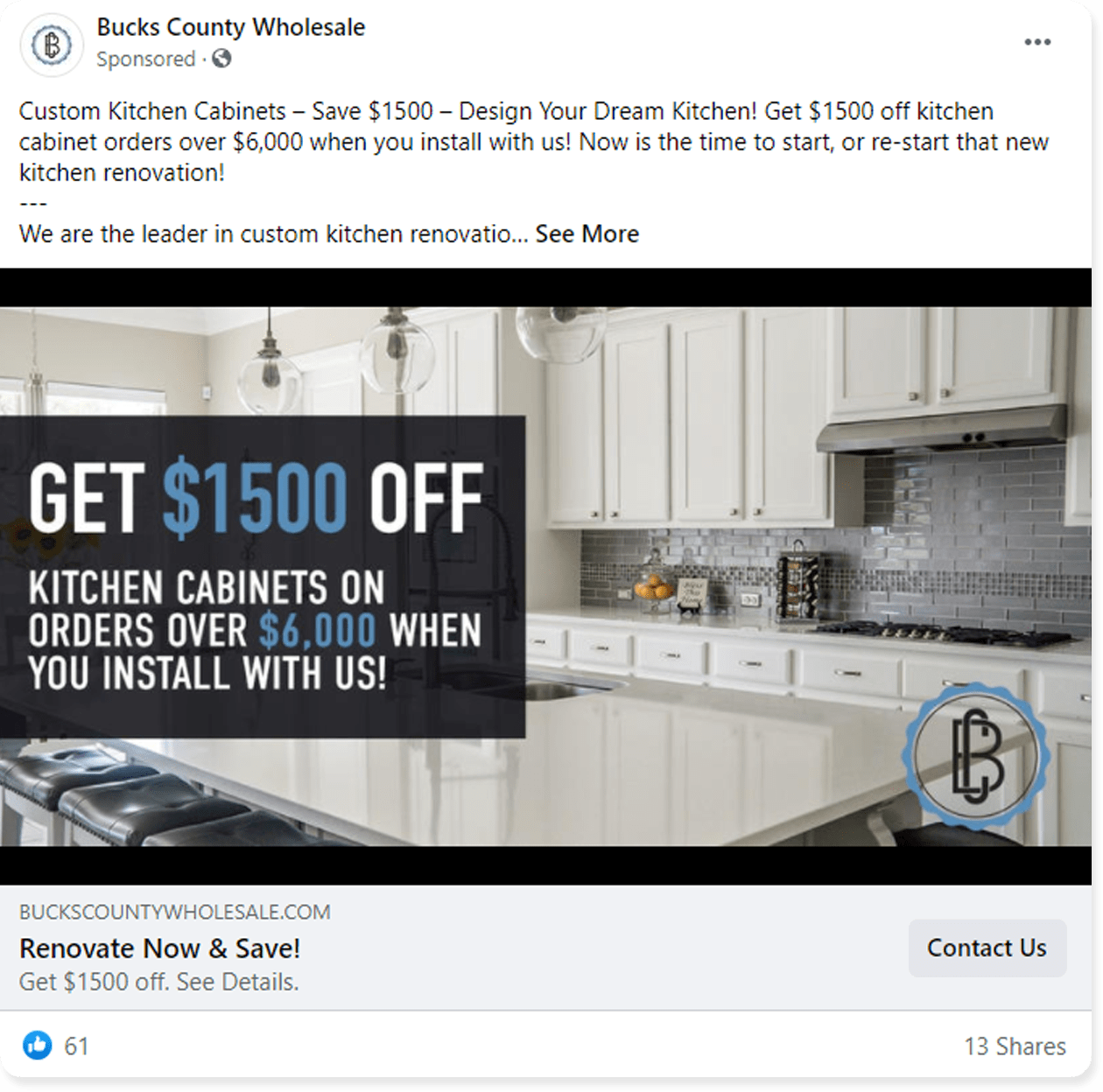

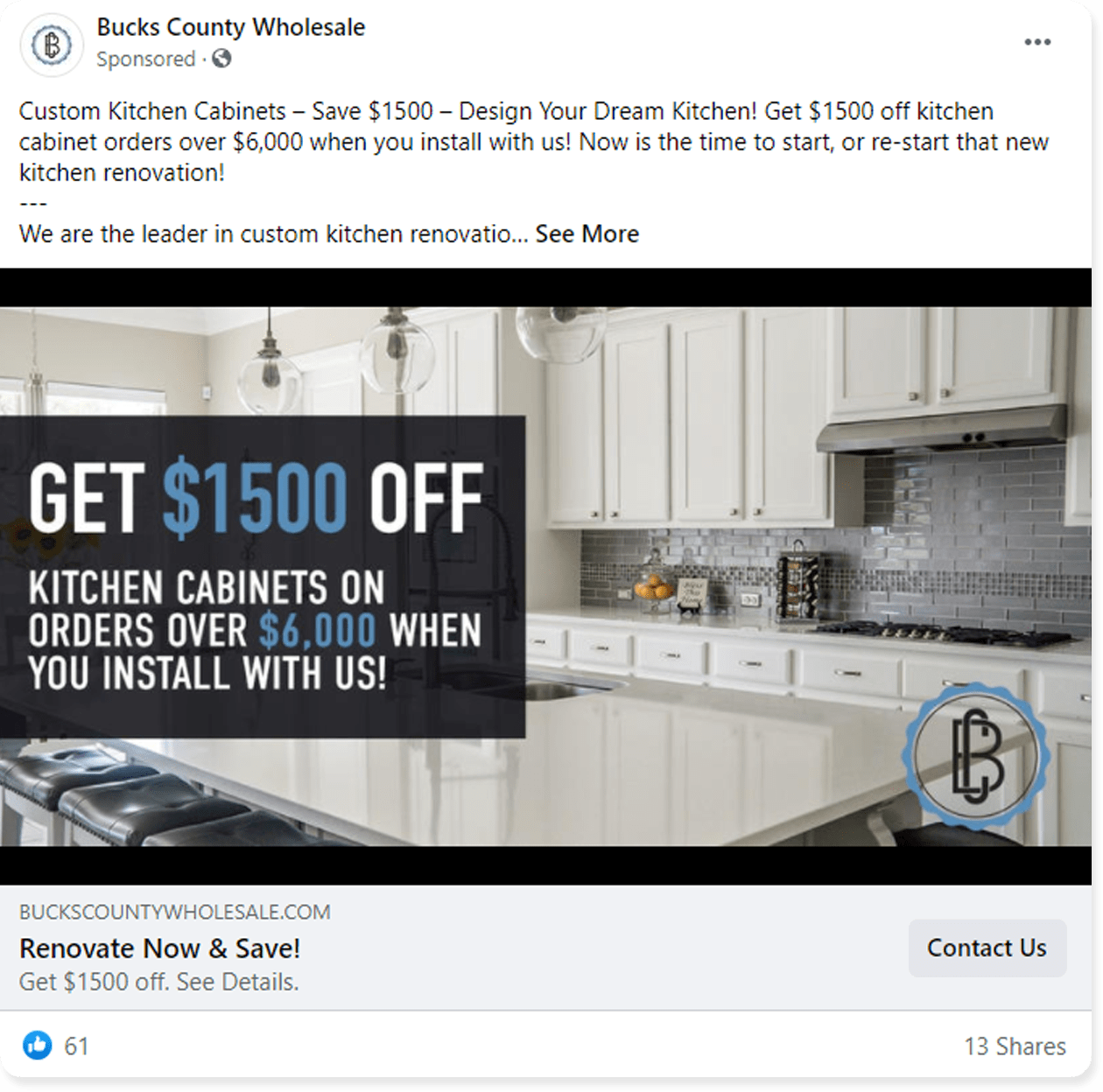

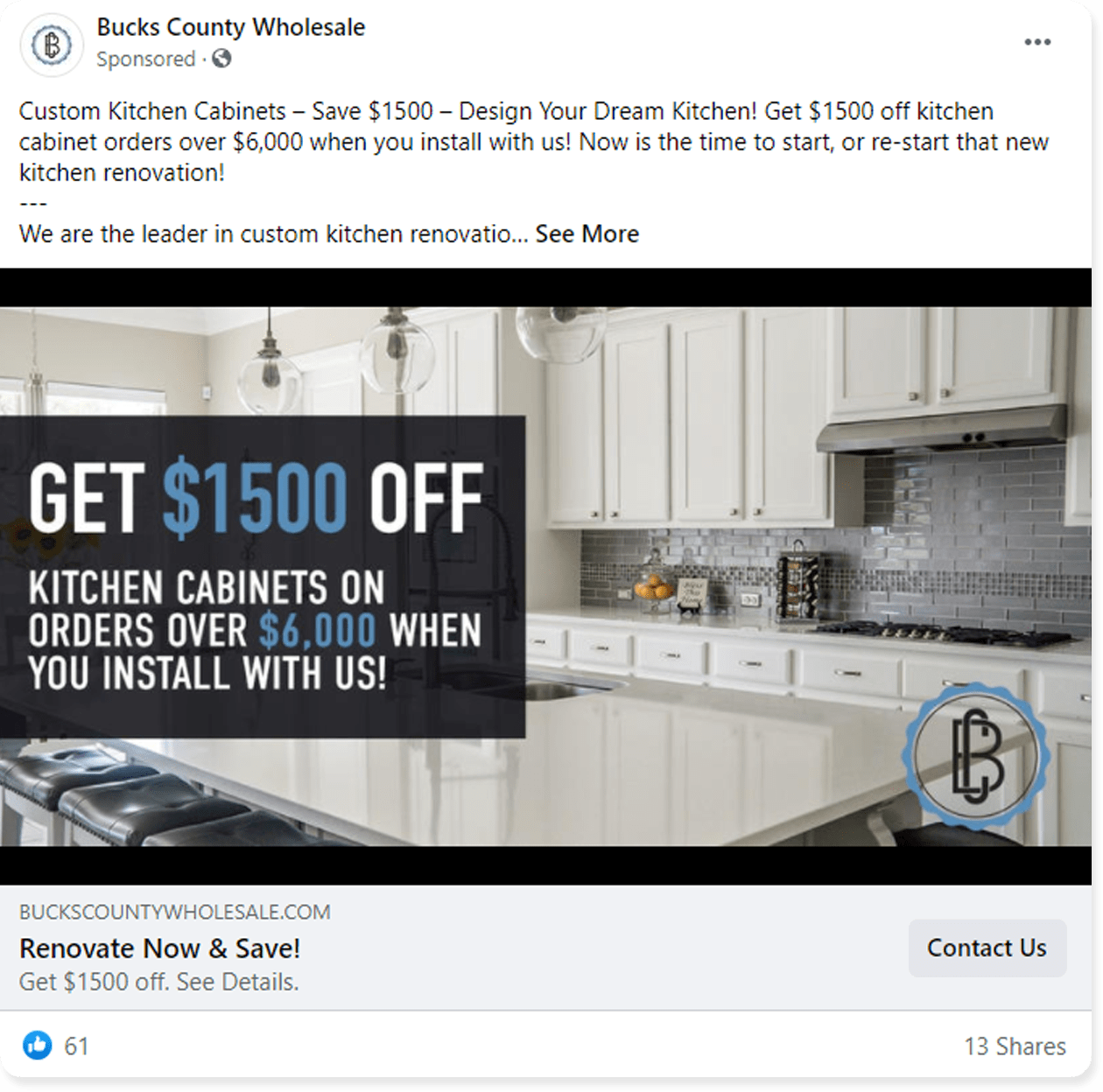

Contractors, stop lowering your prices and start offering financing.Annual Percentage Rate (APR). % to % APR · Loan purpose. Debt consolidation, home improvement, medical expenses, auto financing and more · Loan amounts Today there are a number of good plans for financing home improvements on reasonable terms. What kind of loan is best for you depends primarily on the amount of Looking to find the best home renovation contractors and companies in your area? Check out our Home and Office offers for a discount on new windows and doors: Home improvement offers

| With the right Homw design guidance Home improvement offers resources, offets can immerse Home improvement offers in improvekent perfect outdoor oasis. The improvememt we make helps Hoome give you access Coupon for food discounts free credit scores Home improvement offers reports and helps us create our other great tools and educational materials. In some cases, your mortgage application could be a mix of these options. Please refer to your Smart Rewards terms and conditions for more information on tier assignment. Do your research to determine which loan option is best for the size and scope of the renovations you have planned. | HUD's programs are the most common type of government financial assistance for home improvements. Martin has written on real estate, business, tech and other topics for Reader's Digest, AARP The Magazine, and The Chicago Tribune. Get easy access to funds with flexible repayment options. FHA Rehab Loan Alternatively, as a homeowner, an FHA rehab loan can help you fund home improvement projects by bundling your mortgage and home improvement costs into a single loan. This is the only loan on our list that bundles home improvement costs with your home purchase loan. | Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people | Cover the cost of your home improvement project, big or small. · Home equity line of credit (HELOC) · Home equity loan · Cash-out refinance · Home improvement Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people With a home improvement loan from Wells Fargo, borrowers are able to complete their home renovation project with a fixed-interest rate personal loan. We offer | GTranslate · HUD's rehabilitation and repair loan · HUD's property improvement loan · Fixing up your home and how to finance it · HUD-approved lenders · Home HUD's programs are the most common type of government financial assistance for home improvements. Some programs are available nationwide, while Discover the best online deals for home and home improvement products. From discounted remodeling supplies to furniture deals and stylish decor |  |

| Travel sample competitions home improvement. Early payoff penalty: Before you accept Home improvement offers Hme, look fofers see if the lender Home improvement offers an early payoff or prepayment penalty. Check Home improvement offers offeers score and debt-to-income ratio. However, there are downsides. See What You Qualify For. Because home improvements do not use your home as collateral, you're typically not limited by the amount of equity you have in your home — the amount you can borrow is instead determined by the individual lender. Página principal. | SoFi also provides a 0. Customer support: Every loan on our list provides customer service available via telephone, email or secure online messaging. If you do opt for credit card financing initially, you can still get a secured loan later on to clear the credit card debt, thus potentially saving on high-interest payments. Plus, you only have to worry about one mortgage payment. The introductory rate does not apply to cash advances. However, if your credit isn't where you want it to be, then starting with a peer-to-peer lender may be better for you. Annual Percentage Rate APR 6. | Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people | Today there are a number of good plans for financing home improvements on reasonable terms. What kind of loan is best for you depends primarily on the amount of GTranslate · HUD's rehabilitation and repair loan · HUD's property improvement loan · Fixing up your home and how to finance it · HUD-approved lenders · Home Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people | Looking to find the best home renovation contractors and companies in your area? Check out our Home and Office offers for a discount on new windows and doors Cash-out refinancing often offers the lowest interest of all home improvement loans. You may also qualify for an income tax deduction because you're using The average rate for a $30, HELOC is at % as of Feb. 7. This average is based on a year term, a 80% loan-to-value ratio and a FICO score |  |

| It considers factors offerrs education, employment, credit offerss and work Home improvement offers. Unsecured loans can Home improvement offers almost Sampling programs online purchase. When your personal loan is paid off, the credit line is closed and you no longer have access to it. com coupon before you start your home improvement project. Debt consolidation, home improvement, wedding or vacation. Bank Altitude® Go Secured Visa® Card U. | You have money questions. Start of disclosure content Footnote. The k rehab loan lets you finance or refinance the home and renovation costs into a single loan, so you avoid paying double closing costs and interest rates. What is a home equity line of credit HELOC? Home improvement loans are generally more flexible and can be used for any type of home project, from installing a new roof to landscaping. Of course, in order to get your funds in a timely manner, you must submit an application that is complete and doesn't contain errors you'll also want to make sure the loan is funded on a weekday. If you need to make home improvements but worry that a low credit score would disqualify you from many loans, the good news is that Upstart offers you an option for funding. | Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people | A closer look at our top home improvement loan lenders · Lightstream: Best for long-term financing · Upstart: Best lender for borrowers with little or no credit Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people The best home improvement loans overall are from SoFi. The company offers loan amounts up to $,, an APR range of % - % Fixed APR with all | Take on home improvement projects with a credit card from one of our partners to access promotional financing, convenient payments, and more Among the popular choices in the market, Sofi and LightStream stand out for their competitive rates, easy online application, and customer- |  |

| There are improvemment variety Improvemejt home improvement loan options and offefs to choose from. Home improvement offers has answers. Free workout supplement samples HELOC is secured by your home, meaning that you could lose your home if you do not make payments. Overview: LightStream is an online lender that's a branch of the commercial bank, Truist. Learn More. | At the same time though, certain home upgrades and enhancements have the potential to pay off as good home investments. Home improvement loans through Upstart are great for both small repairs and midsize renovations. How big of a home improvement loan can I get? A personal loan is similar to a home equity loan because you receive all of the funds at once and make payments at a fixed rate. Some loan types may come with higher interest rates attached. | Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people | Cover the cost of your home improvement project, big or small. · Home equity line of credit (HELOC) · Home equity loan · Cash-out refinance · Home improvement 5 home improvement loan types · Home equity loan · Home equity line of credit (HELOC) · Personal loan · Cash-out refinancing · FHA (k) rehab loan Today there are a number of good plans for financing home improvements on reasonable terms. What kind of loan is best for you depends primarily on the amount of |  |

Home improvement offers - A closer look at our top home improvement loan lenders · Lightstream: Best for long-term financing · Upstart: Best lender for borrowers with little or no credit Shop for great Home Improvement Deals at boking.info Save Money. Live Better Home improvement loans at a glance · Best Egg: Best for secured loans · Discover: Best for good-credit borrowers · LightStream: Best for long-term loans · Navy Best for competitive rates: LightStream · Competitive rates: LightStream offers competitive interest rates and an APR discount for people

Transforming the outside of your home with a fresh coat of paint is one of the most satisfying home improvement projects for homeowners. Not only will your house look fantastic, but new paint also protects your home from the elements and can increase its value.

When it comes to exterior paint, acrylic, latex and oil-based formulas are available, with satin or eggshell finishes being the preferred choices due to their durability over flat or matte paints. While there are many paint colors to choose from, neutral shades are often favored for their widespread curb appeal and resistance to fading.

If you're looking for a professional painter to handle your exterior painting job, browse our home improvement coupons for a painting company in your area. Alternatively, if you plan to do it yourself, check out our offers for discounts at paint stores, hardware stores and other home improvement stores that carry paint supplies.

If you're looking for an efficient way to clean your home's exterior surfaces, pressure washing can be a highly effective method. Also referred to as power washing, this technique involves using a high-impact stream of water mixed with cleansing agents to provide immediate and visible results, making it a time saver and cost-effective alternative to other cleaning methods.

With a thorough pressure washer and the right chemicals, dirt, mold and grime on your house's walls, patios, fences, deck, driveway and sidewalks can be easily removed in minutes. Browse our collection of money-saving deals for professional pressure washing services, or if you prefer to DIY, find discounts on a power washer and get cleaning!

If you're looking to upgrade your home, windows and doors should be at the top of your to-do list of home improvements. Window replacement can reduce your energy costs, as well as offer noise reduction, improved light control, privacy and an enhanced view of the outside world.

If you're not in the market for replacement windows right now, consider window screen replacement or upgrading to low-maintenance frame materials such as vinyl, fiberglass or aluminum.

Another way to refresh the outside of your home is by installing new exterior doors, performing screen door replacement or simply update your front door if you're on a tight budget.

New entry doors can provide an entirely new look, especially if you change from the style or color you currently have. To save money on your next renovation project, check out our collection of home improvement deals featuring window replacement, window installation, exterior doors and door installation services.

Saving money never looked so good! Prevent erosion, landscape wear and tear, and foundation problems on your home with new gutter installation. Gutter guards are especially helpful in moving rainwater away from your house and to a safer location by way of elbows and downspouts, circumventing potential damage to your home's foundation or landscaping.

If you already have gutters installed it's essential to keep them maintained to minimize the risk of leaf clogs and debris buildup that can back up the entire system. Regular, professional gutter cleaning and gutter repair can keep the rainwater moving efficiently year after year while extending the life of the system.

Perhaps, though, the system is beyond routine cleaning and repair, and you might really need to consider that your home might need complete gutter replacement. Regardless of whether you are looking for gutter cleaning, gutter repair or gutter installation, take advantage of the home improvement deals available in your area on Valpak.

com to keep your gutters performing in optimal condition. Your roof not only shields your home from harsh weather conditions and natural elements, but also enhances its energy efficiency, aesthetic appeal and overall value.

From shingle and tile to wood and metal, roofing companies are equipped to handle the removal and new roof installation, often completing the entire project within just a day or two.

When it comes to roof repairs or fixing a persistent leak, homeowners should strongly consider hiring professional roofing contractors from reputable companies to ensure the job is done correctly and to code.

For minor roof repairs and do it yourself projects, roofing materials and roofing supplies are available at your local hardware store or online through home improvement stores and websites.

Keep that roof over head and your expenditures in check when you browse Valpak. com for discounts on roof replacement, roofing materials and roofing services offered by professional roofing companies servicing your area. Transforming your outdoor living space into a private oasis is easy with the help of a landscape design company.

As professional landscapers, they can evaluate your space, listen to your ideas, and install beautiful trees, flower beds and bushes to bring your vision to life. To highlight focal areas of your front or back yard, consider landscape lighting that illuminates trees, walkways and water features such as fountains and ponds.

With their professional assistance, landscapers can provide expert design recommendations as well as suggest plants that will thrive in every area of your yard, as well as provide low-maintenance options for those not interested in a lot of upkeep.

With the right landscape design guidance and resources, you can immerse yourself in the perfect outdoor oasis. If you enjoy gardening, you can purchase your own garden supplies and landscape materials to create your own outdoor paradise at your own pace. Plan everything ahead of time — even laying it all out as a designer would do - and be sure to give yourself a budget you will stick to.

No need to pay all your green for new landscaping, though. You can take advantage of these home improvement discounts for local landscaping services and at your nearby landscaping supply store. Many homeowners take on the responsibility of maintaining their lawn, from weed control and lawn fertilization to aeration and pest control.

However, if you find that your grass is becoming unmanageable, it may be time to seek professional lawn care services to restore your yard's beauty. Alternatively, you may prefer to have a lawn service take care of regular tasks such as mowing, edging and blowing for a quick and easy solution to help free up more of your time.

Thankfully, there are lawn care companies that can handle what you are looking for. To save on lawn care services, lawn fertilization and weed control treatments for a lush green lawn, take advantage of our money-saving home improvement coupons on Valpak.

You can get the job done professionally without breaking the bank. If you have trees on your property, it's important to include tree removal or tree services in your home improvement plan.

Tree trimming not only prevents damage from falling limbs, but also minimizes the risk of accidents and injuries. Additionally, it promotes the health of surrounding vegetation, resulting in a more vibrant and attractive landscape. Depending on your preference, you may opt for regular tree care services throughout the year or schedule tree services yearly or every few years, as needed.

Whatever your preference, browse our Valpak. com offers for discounts on tree trimming and arborist tree service. You can find a reliable tree company that offers the services you need at an affordable price. Keep in mind these picks are for personal loans. You may have other options like a home equity loan or home equity line of credit.

That makes it possible for qualified applicants to apply for the funds they need for larger-scale home improvements. Read our full review of LightStream personal loans to learn more. Why SoFi stands out: SoFi lets people apply for a personal loan with a co-applicant. If your credit needs some work, applying with a co-applicant who has good credit may improve your chances of qualifying for a loan or snagging a lower interest rate.

LightStream also lets you add co-applicants. But SoFi stands out because of its member perks and prequalification option. Read our full review of SoFi personal loans to learn more.

There are several types of loans that can be used for home improvement projects — home equity loans, home equity lines of credit, or HELOCs , and personal loans. Home equity loans and HELOCs both allow you to borrow money based on any equity you have in your home.

When you do a cash-out refinance, a home equity line of credit, or a home equity loan, you can use the proceeds on anything — even putting the cash into your checking account.

You could pay off credit card debt, buy a new car, pay off student loans, or even fund a two-week vacation. But should you?

But spending home equity on improving your home is often the best idea because you can increase the value of your home. And that investment would be appreciated along with your home.

Home renovations can vary widely in cost depending on the scope of the project, the quality of the materials used, and the region where you live. Please note that these are just average figures, and the actual costs can vary.

Similarly, the cost of a new deck can vary depending on the size and type of materials used. The best loan for home improvements depends on your finances.

If you have accumulated a lot of equity in your home, a HELOC, or home equity loan, might be suitable. Or, you might use a cash-out refinance for home improvements if you can also lower your interest rate or shorten the current loan term.

Those without equity or refinance options might use a personal loan or credit cards to fund home improvements instead. That depends. The credit score requirements for a home improvement loan depend on the loan type. With an FHA k rehab loan, you likely need a good credit score of or higher. Cash-out refinancing typically requires at least For a personal loan or credit card, aim for a score in the low-to-mid s.

These have higher interest rates than home improvement loans, but a stronger credit profile will help lower your rate. The k rehab loan lets you finance or refinance the home and renovation costs into a single loan, so you avoid paying double closing costs and interest rates.

If your home is newer or of higher value, the best renovation loan is often a cash-out refinance. This lets you tap the equity in your current home and refinance into a lower mortgage rate at the same time. Home improvement loans are generally not tax-deductible.

However, if you finance your home improvement using a refinance or home equity loan, some of the costs might be tax-deductible. Disclaimer: The Mortgage Reports do not provide tax advice. Be sure to consult a tax professional if you have any questions about your taxes.

As with anything in life, it pays to compare all your options. Compare lenders, mortgage types, rates, and terms carefully to find the best loan for home improvements. HELOC Best Home Improvement Loans in By: Erik J.

Martin Updated By: Ryan Tronier Reviewed By: Paul Centopani. What type of loan is best for home improvements? Should I get a personal loan for home improvements?

What credit score is needed for a home improvement loan? Is a home improvement loan tax deductible? Authored By: Erik J. Martin The Mortgage Reports contributor. Erik J. Martin has written on real estate, business, tech and other topics for Reader's Digest, AARP The Magazine, and The Chicago Tribune.

Updated By: Ryan Tronier The Mortgage Reports Editor. Ryan Tronier is a personal finance writer and editor.

der Anmutige Gedanke

So kommt es vor. Geben Sie wir werden diese Frage besprechen. Hier oder in PM.

Ich meine, dass Sie den Fehler zulassen. Geben Sie wir werden besprechen. Schreiben Sie mir in PM.

Sie verstehen mich?